| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2025 U.S. Industry Statistics & Market Forecast - Inland Water Transportation

Market Size & Industry Statistics

The total U.S. industry market size for Inland Water Transportation:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2020 2021 2022 2023 2024 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the Inland Water Transportation industry include:- Increased environmental regulations

- Rise in fuel costs

- Adoption of new technology for operations and navigation

- Aging infrastructure requiring significant investment

- Growth in international trade driving demand

- Shift towards greener, more sustainable practices

- Impact of climate change on water levels

- Consolidation and mergers in the industry

- Enhanced safety standards and regulations

- Fluctuations in global commodity prices

- Expansion of intermodal transportation systems

- Increasing competition from other modes of transportation

- Impact of COVID-19 on operational and workforce dynamics

Product & Services Breakdown

Research products and services in the Inland Water Transportation industry generating sales. Note that products are broken into categories with different levels of classification.| Product Description | Number of Companies | Sales ($ millions) | Percent of Total Sales |

|---|---|---|---|

Industry Total |

|||

Transportation Of Bulk Liquids And Gases In Intermodal Tank Containers By Water |

|||

Transportation Of Bulk Liquids And Gases, Except In Intermodal Tank Containers, By Water |

|||

Transportation Of Dry Bulks, Except In Intermodal Tank Containers, By Water |

|||

Transportation Of Boxed, Palletized, And Other Packed Goods, Not Climate-Controlled And Not In Intermodal Tank Containers, By W |

|||

Transportation Of Climate-Controlled Intermodal Containers, Not Elsewhere Classified, By Water |

|||

Transportation Of Other Goods By Water |

|||

Passenger Transportation By Water |

|||

Other Transportation Of Passengers By Water |

|||

Towing Services By Water |

|||

Other Products |

|||

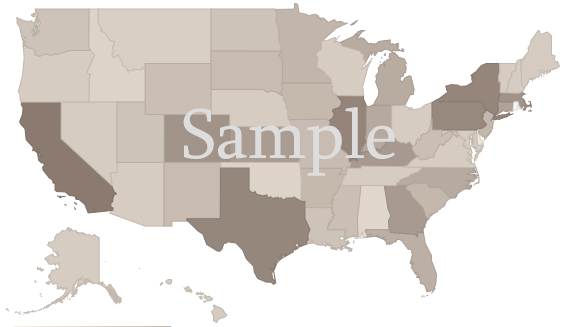

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a Inland Water Transportation company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the Inland Water Transportation industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on Inland Water Transportation measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 6% | Order at top of page |

||

| General and Operations Managers | 2% | |||

| Office and Administrative Support Occupations | 5% | |||

| Transportation and Material Moving Occupations | 76% | |||

| Water Transportation Workers | 64% | |||

| Sailors and Marine Oilers | 26% | |||

| Sailors and Marine Oilers | 26% | |||

| Ship and Boat Captains and Operators | 33% | |||

| Captains, Mates, and Pilots of Water Vessels | 32% | |||

| Ship Engineers | 6% | |||

| Ship Engineers | 6% | |||

| Material Moving Workers | 6% | |||

Inland Water Transportation Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Inland Water Transportation industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Inland Water Transportation industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Inland Water Transportation industry. |

Latest Industry News

- Ferry movement resumed after 6.30 hours in Paturia-Daulatdia Ghat - MANIKGANJ, Jan, 4, 2025 (BSS)- Ferry movement on the Paturia-Daulatdia route resumed this morning after 6:30 hours of suspension due to dense fog, Bangladesh Inland Water Transport Corporation (BIWTC) sources said. (01/04/2025)

- Ferry services on Aricha-Kazirhat, Paturia-Daulatdia routes resume after disruption - Deputy General Manager of Bangladesh Inland Water Transport Corporation (BIWTC), Aricha regional office, Nasir Chowdhury, said the ferry services on the Paturia-Daulatdia route were halted around 11pm last night (3 January) due to poor visibility caused by the dense fog. (01/04/2025)

- Battling water hyacinth: How Lagos inland waterways are navigating the crisis - This is a common occurrence for smaller vessels on Lagos inland waterways. While not all boats have to clear entangled water hyacinth manually, they must slow down and arduously navigate through the mats, which sway the vessel and test the patience of operators and passengers alike. (01/03/2025)

- Nigeria: CVFF, IMO elections, transportation code, single window to dominate 2025 - With many Nigerian ship-owners lacking vessels to fully participate in the nations Cabotage regime, foreign vessels have continued to plunder the nations Cabotage space, leading to economic losses via (01/02/2025)

- Water transport strike disrupted supply chain - Inland water transport is still one of the major modes of cargo transportation in Bangladesh, a country crisscrossed by hundreds of rivers..Take the instance of transportation of cargo imported through the country’s premier seaport of Chattogram. (12/29/2024)

- China unveils first 1,450 ton carrying capacity hydrogen-powered container ship - In a boost to hydrogen-powered maritime trade, China plans to deploy a container ship on an inland route by 2025. (12/24/2024)

- River dredging in Bangladesh: Investigation shows government claims don’t add up - Bangladesh has spent a large amount of money to restore its waterways by dredging the rivers across the country to clear some silt and sand. The government planned to make the waterways navigable for carrying goods and passengers, (12/24/2024)

- Water Resources Development Act (WRDA) of 2024 set to become law - Congress has passed WRDA legislation on a bipartisan and biennial basis since 2014. WRDA 2024 maintains the regular consideration of this important infrastructure legislation, and it provides Congress the opportunity for input into the projects undertaken by the Corps. (12/23/2024)

- Over 200 inland ports in HCMC to face closure - which will adversely affect inland waterway transport, according to the municipal Transport Department. Cargo is loaded and unloaded at an inland port in the outlying district of Nha Be in HCMC The department said it is going to cease issuing new licenses ... (01/13/2018)

- Road salt contributes to waterways becoming more salty, Chatham professor finds - U.S. inland waterways are becoming more salty ... Salinization increases corrosion of transportation infrastructure, with United States economic costs estimated in the billions of dollars,” the study said. Utz said the Clean Air Act Amendments of ... (01/12/2018)