| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2024 U.S. Industry Statistics & Market Forecast - Computer and Peripheral Equipment Manufacturing

Market Size & Industry Statistics

The total U.S. industry market size for Computer and Peripheral Equipment Manufacturing:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2019 2020 2021 2022 2023 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the Computer and Peripheral Equipment Manufacturing industry include:- Increasing demand for eco-friendly and sustainable products

- Rapid advancements in technology and innovation

- Growing integration of AI and machine learning

- Shift towards remote work increasing demand for personal computing devices

- Expansion of global supply chains and outsourcing

- Heightened competition from emerging markets and global players

- Proliferation of IoT and connected devices

- Rise of cyber security threats demanding enhanced security features

- Increasing consumer preference for compact and multi-functional devices

- Challenges in sourcing due to geopolitical tensions and trade restrictions

- Impact of COVID-19 on production, demand, and supply chain disruptions

- Greater focus on product lifecycle management and recycling initiatives

- Shift towards cloud computing reducing demand for certain peripherals

- Adoption of 3D printing technologies in manufacturing processes

- Increasing regulatory pressures related to electronic waste and energy consumption

- Emergence of flexible and remote workspaces driving new product formats

- Increased investment in R&D to stay competitive in fast-evolving markets

- Integration of virtual and augmented reality in computing devices

- Growing popularity of gaming, driving demand for high-performance peripherals

- Challenges in maintaining manufacturing operations amid rising labor costs

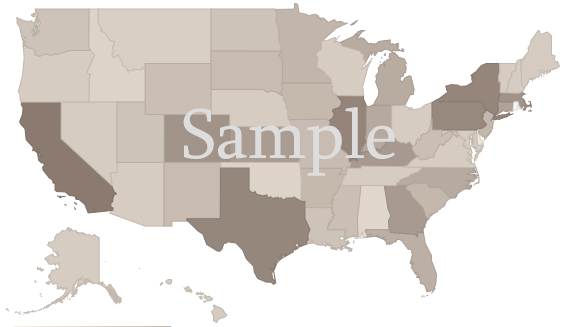

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a Computer and Peripheral Equipment Manufacturing company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the Computer and Peripheral Equipment Manufacturing industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on Computer and Peripheral Equipment Manufacturing measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 14% | Order at top of page |

||

| Chief Executives | 0% | |||

| General and Operations Managers | 3% | |||

| Business and Financial Operations Occupations | 12% | |||

| Business Operations Specialists | 9% | |||

| Computer and Mathematical Occupations | 24% | |||

| Computer Occupations | 23% | |||

| Software and Web Developers, Programmers, and Testers | 16% | |||

| Software Developers | 13% | |||

| Architecture and Engineering Occupations | 12% | |||

| Engineers | 10% | |||

| Sales and Related Occupations | 9% | |||

| Sales Representatives, Wholesale and Manufacturing | 6% | |||

| Sales Representatives, Wholesale and Manufacturing | 6% | |||

| Office and Administrative Support Occupations | 7% | |||

| Production Occupations | 16% | |||

| Assemblers and Fabricators | 10% | |||

| Electrical, Electronics, and Electromechanical Assemblers | 7% | |||

| Electrical, Electronic, and Electromechanical Assemblers, Except Coil Winders, Tapers, and Finishers | 7% | |||

Computer and Peripheral Equipment Manufacturing Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Computer and Peripheral Equipment Manufacturing industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Computer and Peripheral Equipment Manufacturing industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Computer and Peripheral Equipment Manufacturing industry. |

Source:

Innovation News

- Jun 13, 2024: Apple patents Respiratory Measurement System

- Jun 13, 2024: Apple patents Packaging With Integrated Cushioning Supports

- Jun 13, 2024: Apple patents Electronic Devices With Movable Optical Assemblies

- Jun 04, 2024: Sensel raises $47 million in funding.

- Apr 17, 2024: Safety Spect raises $10 million in funding.

- Apr 08, 2024: Zephyr Computing Systems raises $6 million in funding.

- Jan 31, 2024: Rouchon Industries trademarks "ZTX" - computer hardware; computer motherboards

- Jan 26, 2024: Arnouse Digital Devices trademarks "LAPDOCK" - Computer hardware and computer peripherals

- Jan 24, 2024: Princeton Identity trademarks "EYEALLOW" - Computer hardware, software and firmware for biometric recognition, identification and authentication.

Recent Federal Contracts for Computer and Peripheral Equipment Manufacturing

- Apr 02, 2024: IMAGING BUSINESS MACHINES, L.L.C. (Birmingham, AL) awarded $685,605

- Apr 02, 2024: DIGITAL INTELLIGENCE, INC. (New Berlin, WI) awarded $36,367

- Apr 02, 2024: SOLVIX SOLUTIONS LLC (Marlton, NJ) awarded $1,378

- Apr 02, 2024: WHITAKER BROTHERS BUSINESS MACHINES INC (Rockville, MD) awarded $4,246

- Apr 02, 2024: RED RIVER TECHNOLOGY LLC (Claremont, NH) awarded $133,132

- Apr 02, 2024: EMERGENT, LLC (Virginia Beach, VA) awarded $613,701

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.