| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2025 U.S. Industry Statistics & Market Forecast - General Automotive Repair

Market Size & Industry Statistics

The total U.S. industry market size for General Automotive Repair:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2020 2021 2022 2023 2024 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the General Automotive Repair industry include:- Increased adoption of electric vehicles

- Advancements in vehicle technology and diagnostics

- Growing demand for eco-friendly services

- Rising popularity of mobile repair services

- Expansion of aftermarket services

- Integration of AI and data analytics for predictive maintenance

- Regulatory changes and emission standards

- Shift towards subscription-based and bundled service packages

- Increase in the average age of vehicles on the road

- Impact of economic fluctuations on consumer spending patterns for maintenance

- Heightened importance of cybersecurity in automotive systems

Product & Services Breakdown

Research products and services in the General Automotive Repair industry generating sales. Note that products are broken into categories with different levels of classification.| Product Description | Number of Companies | Sales ($ millions) | Percent of Total Sales |

|---|---|---|---|

Industry Total |

|||

Body Repair Services For Cars And Light Trucks |

|||

Body Repair Services, Major And Minor For Cars And Light Trucks |

|||

Painting Services For Cars And Light Trucks |

|||

Wheel And Alignment Services For Cars And Light Trucks |

|||

Scheduled, Factory-Recommended, And Preventative Maintenance Services For Cars And Light Trucks |

|||

Oil Change Services For Cars And Light Trucks |

|||

Other Scheduled, Factory-Recommended, And Preventative Maintenance Services For Cars And Light Trucks |

|||

Powertrain, Engine, And Transmission Repair Services For Cars And Light Trucks |

|||

Brake Repair Services For Cars And Light Trucks |

|||

Electrical/Electronic System Repair Services For Cars And Light Trucks |

|||

Muffler And Exhaust Systems Repair Services For Cars And Light Trucks |

|||

Tire Repair Services For Cars And Light Trucks |

|||

Heating, Air Conditioning, And Radiator System Repair Services For Cars And Light Trucks |

|||

Regulatory Safety Inspections And Emissions Testing Services For Cars And Light Trucks |

|||

Other Repair Services For Cars And Light Trucks |

|||

Maintenance And Repair Services For Motor Homes, Travel Trailers, And Campers |

|||

Body Repair Services For Heavy Trucks And Buses |

|||

Body Repair Services, Major And Minor For Heavy Trucks And Buses |

|||

Other Body Repair Services For Heavy Trucks And Buses |

|||

Wheel And Alignment Services For Heavy Trucks And Buses |

|||

Scheduled, Factory-Recommended, And Preventative Maintenance Services For Heavy Trucks And Buses |

|||

Powertrain, Engine, And Transmission Repair Services For Heavy Trucks And Buses |

|||

Brake Repair Services For Heavy Trucks And Buses |

|||

Electrical/Electronic System Repair Services For Heavy Trucks And Buses |

|||

Tire Repair Services For Heavy Trucks And Buses |

|||

Regulatory Safety Inspections And Emissions Testing Services For Heavy Trucks And Buses |

|||

Other Repair Services For Heavy Trucks And Buses |

|||

All Other Maintenance And Repair Services |

|||

Resale Of Merchandise |

|||

Resale Of Merchandise - Parts And Supplies For Road Vehicles Not Included In Repair Work |

|||

Used Cars, Trucks, And Other Transportation Vehicles |

|||

Other Merchandise |

|||

All Other Receipts |

|||

All Other Operating Receipts |

|||

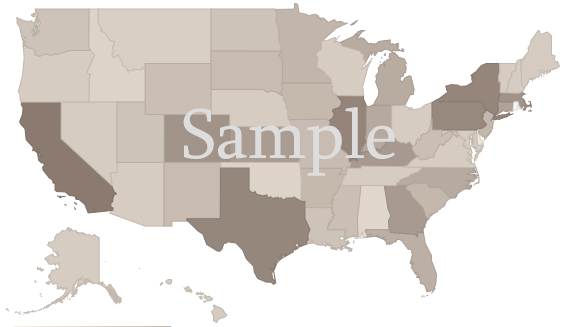

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a General Automotive Repair company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the General Automotive Repair industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on General Automotive Repair measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 6% | Order at top of page |

||

| Top Executives | 6% | |||

| Chief Executives | 0% | |||

| General and Operations Managers | 6% | |||

| General and Operations Managers | 6% | |||

| Sales and Related Occupations | 6% | |||

| Retail Sales Workers | 5% | |||

| Office and Administrative Support Occupations | 13% | |||

| Installation, Maintenance, and Repair Occupations | 66% | |||

| Supervisors of Installation, Maintenance, and Repair Workers | 7% | |||

| First-Line Supervisors of Mechanics, Installers, and Repairers | 7% | |||

| First-Line Supervisors of Mechanics, Installers, and Repairers | 7% | |||

| Vehicle and Mobile Equipment Mechanics, Installers, and Repairers | 57% | |||

| Automotive Technicians and Repairers | 49% | |||

| Automotive Service Technicians and Mechanics | 47% | |||

| Bus and Truck Mechanics and Diesel Engine Specialists | 6% | |||

| Bus and Truck Mechanics and Diesel Engine Specialists | 6% | |||

| Transportation and Material Moving Occupations | 5% | |||

General Automotive Repair Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the General Automotive Repair industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the General Automotive Repair industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the General Automotive Repair industry. |

Latest Industry News

- Ford Escape extended warranty: cost, coverage and plans - All new Ford Escapes come with a three-year/36,000-mile bumper-to-bumper warranty and a five-year/60,000-mile powertrain warranty from the factory. Quotes we received for an extended auto warranty on a 2021 Escape ranged from $1,039.80 to $2,723.12 a year. That’s more expensive than the average cost of an extended warranty. (01/03/2025)

- These states have the most car repair shops - As many Americans are driving older cars, The General used Bureau of Labor Statistics data to map the concentration of auto repair shops by state. (01/02/2025)

- National General Insurance Review 2025 - In our auto insurance reviews ... Guaranteed repairs. National General covers collision repairs made at any of their Gold Medal Repair Shops for the lifetime of the vehicle. (01/02/2025)

- Bonding, Aftermarket Parts Disclosures Won’t Fall Under Maine Right to Repair Law, Group Decides - At the latest meeting of a group drafting legislation, a state official said proposed language doesn’t fit the scope of the report. (12/30/2024)

- Auto repair workshop firm hoping to expand into Colchester for first time - Fix Auto Chelmsford, which is part of the chain Fix Auto UK, has submitted a planning application to Colchester Council on December 6. The business focuses on fixing cars that have been damaged in traffic related incidents which a driver has contacted their insurance company about. (12/22/2024)

- Automakers excoriated by Senators for fighting right-to-repair - Yesterday, US Senators Jeff Merkley (D-OR), Elizabeth Warren (D-MA), and Joshua Hawley (R-MO) sent letters to the heads of Ford, General Motors, and Tesla, as well as the US heads of Honda, Hyundai, Nissan, Stellantis, Subaru, Toyota, and Volkswagen, excoriating them over their opposition to the right-to-repair movement. (12/20/2024)

- FYI, Rinsing Your Dishes Before They Go In The Dishwasher Might Just Leave Them Dirtier - Holly Moore, founder and owner of in-home cleaning company Maids and Moore, told HuffPost that rinsing dishes before putting them in the dishwasher is a common mistake she sees people make in the kitchen. While you still should scrape food off the plate, rinsing your dishes is completely unnecessary. (12/18/2024)

- asTech® Driven by Repairify Partners with Auto-Wares to Enhance Automotive Diagnostics and Repair Solutions - PLANO, Texas, Dec. 9, 2024 /PRNewswire/ -- Repairify, the global leader in remote diagnostics, calibrations, programming, and automotive intelligence for the collision and mechanical repair ... (12/09/2024)

- Gardens Casino in Hawaiian Gardens will pay $3.1 million settlement - “There’s no excuse for failing to comply with the law and deliberately attempting to mislead regulators,” Attorney General Xavier Becerra said in a statement ... nail salon moves and more Mysterious smoke damages Norwalk auto repair shop Out & About: Things to do in the Long Beach area Dec. 6-12 Rich Archbold: Raymond Curry pays ... (12/06/2019)

- Fairfield works to decrease unused, wrecked vehicles in plain sight - These companies can apply for a conditional-use approval within these zoning districts via the city’s Planning Commission. • Repair garages primarily performing general auto repair and auto body repair, including collision services are permitted to have up to nine unlicensed, partially disassembled, wrecked or inoperable vehicles stored on ... (12/05/2019)