| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2024 U.S. Industry Statistics & Market Forecast - Restaurants and Other Eating Places

Market Size & Industry Statistics

The total U.S. industry market size for Restaurants and Other Eating Places:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2019 2020 2021 2022 2023 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the Restaurants and Other Eating Places industry include:- Increased demand for healthy, organic, and locally sourced food options

- Growth in plant-based menu items and alternative proteins

- Expansion of food delivery services and online ordering platforms

- Emphasis on sustainability and eco-friendly practices

- Rise of meal kits and ready-to-eat home meal solutions

- Impact of social media on dining choices and restaurant marketing

- Adoption of digital technologies for menu customization and automation

- Increasing importance of allergen-aware and dietary-specific menus

- Shift towards experiential dining and unique food experiences

- Challenges associated with labor shortages and rising wage costs

- Fluctuations in commodity prices affecting menu pricing strategies

- Heightened consumer expectations for safety and cleanliness, post-pandemic

- Growth in fast-casual dining over traditional full-service restaurants

- Rise of ghost kitchens and virtual restaurants

- Adaptation to new local and international food safety regulations

Product & Services Breakdown

Research products and services in the Restaurants and Other Eating Places industry generating sales. Note that products are broken into categories with different levels of classification.| Product Description | Number of Companies | Sales ($ millions) | Percent of Total Sales |

|---|---|---|---|

Industry Total |

|||

Gambling Services |

|||

Gambling Machine Products |

|||

Sale Of Tickets To Lotteries & Other Games Of Chance |

|||

Room Or Unit Accommodation For Travelers & Others |

|||

Groceries & Other Food Items For Human Consumption Off The Premises |

|||

Alcoholic Beverages Served For Immediate Consumption |

|||

Distilled Spirits Served For Immediate Consumption |

|||

Wine & Wine Drinks Served For Immediate Consumption |

|||

Beer, Ale, & Malt Beverages Served For Immediate Consumption |

|||

Packaged Liquor, Wine, & Beer |

|||

All Other Merchandise |

|||

Souvenirs & Novelty Items |

|||

Meals, Unpackaged Snacks, Sandwiches, Unpackaged Ice Cream & Yogurt, Bakery Items, Other Food Items & Nonalcoholic Beverages Prepared |

|||

Meals & Snacks Served By A Server (I.E., Full Service) |

|||

Nonalcoholic Beverages Served By A Server (I.E., Full Service) |

|||

Meals & Snacks Dispensed W/O Table Service For Consumption On Premises |

|||

Nonalcoholic Beverages Dispensed W/O Table Service For Consumption On The Premises |

|||

Meals & Snacks Dispensed Via Drive-Through Service |

|||

Nonalcoholic Beverages Dispensed Via Drive-Through Service |

|||

Meals & Snacks Prepared For Immediate Consumption Off The Premises |

|||

Nonalcoholic Beverages Prepared For Immediate Consumption Off The Premises |

|||

Meals, Snacks, & Beverages Prepared For Catered Events |

|||

Meals, Snacks & Nonalcoholic Beverages Served At Catered Events On The Caterer's Premises |

|||

Meals, Snacks & Nonalcoholic Beverages Served At Catered Events Away From The Caterer's Premises |

|||

Meals, Snacks & Nonalcoholic Beverages Dropped Off At The Customer's Event |

|||

Meals, Snacks & Nonalcoholic Beverages Prepared For Customer Pick-Up |

|||

Alcoholic Beverages Prepared For Catered Events |

|||

Admissions To Live Performing Arts Performances |

|||

Hosting Of Vending Machines, Video Games, & Other Non-Gambling Coin-Operated Machines |

|||

Delivery Services For Food & Beverages |

|||

Rental Of Non-Residential Space |

|||

Other Services |

|||

All Other Merchandise, Excluding Lottery Ticket Sales/Commissions |

|||

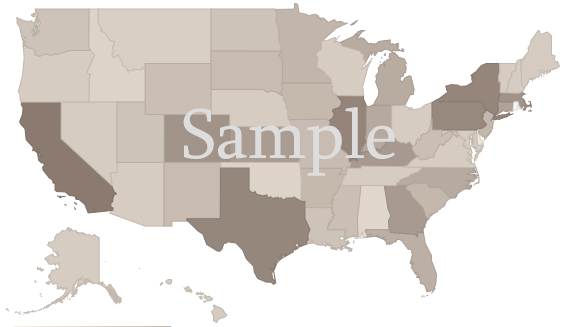

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a Restaurants and Other Eating Places company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the Restaurants and Other Eating Places industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on Restaurants and Other Eating Places measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 3% | Order at top of page |

||

| Chief Executives | 0% | |||

| General and Operations Managers | 1% | |||

| Food Preparation and Serving Related Occupations | 88% | |||

| Supervisors of Food Preparation and Serving Workers | 10% | |||

| Supervisors of Food Preparation and Serving Workers | 10% | |||

| First-Line Supervisors of Food Preparation and Serving Workers | 9% | |||

| Cooks and Food Preparation Workers | 23% | |||

| Cooks | 18% | |||

| Cooks, Fast Food | 7% | |||

| Cooks, Restaurant | 11% | |||

| Food and Beverage Serving Workers | 46% | |||

| Bartenders | 5% | |||

| Bartenders | 5% | |||

| Fast Food and Counter Workers | 26% | |||

| Fast Food and Counter Workers | 26% | |||

| Waiters and Waitresses | 17% | |||

| Waiters and Waitresses | 17% | |||

| Other Food Preparation and Serving Related Workers | 10% | |||

| Dining Room and Cafeteria Attendants and Bartender Helpers | 5% | |||

| Dining Room and Cafeteria Attendants and Bartender Helpers | 5% | |||

| Dishwashers | 6% | |||

| Dishwashers | 6% | |||

| Hosts and Hostesses, Restaurant, Lounge, and Coffee Shop | 7% | |||

| Hosts and Hostesses, Restaurant, Lounge, and Coffee Shop | 7% | |||

Restaurants and Other Eating Places Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Restaurants and Other Eating Places industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Restaurants and Other Eating Places industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Restaurants and Other Eating Places industry. |

Innovation News

- May 21, 2024: Hawaiian Bros raises $1 million in funding.

- May 21, 2024: Chai Pani Holdings raises $4 million in funding.

- Apr 22, 2024: Hawaiian Bros raises $6 million in funding.

- Feb 15, 2024: Zume patents Molded Fiber Product Production Line Utilizing Fluid Trim Operation

- Jan 29, 2024: Moonlight Mile Inc. Dba Steel Wheel Tavern trademarks "RIDGEWOOD NJ STEEL WHEEL TAVERN" - Restaurant services; bar services

- Jan 29, 2024: Moonlight Mile Inc. Dba Steel Wheel Tavern trademarks "STEEL WHEEL TAVERN" - Restaurant services; bar services

- Jan 26, 2024: Starr Restaurant Organization trademarks "RELIABLE DOUGH" - Bar services; Restaurant services

- Jan 04, 2024: keenwawa patents Systems And Method For Determining Qualities Of Non-fungible Tokens

- Nov 16, 2023: Zume patents Porous Mold For Molded Fiber Part Manufacturing And Method For Additive Manufacturing Of Same

Recent Federal Contracts for Restaurants and Other Eating Places

- Feb 20, 2024: RIVER RATS INC (Brunswick, GA) awarded $38,016

- Feb 13, 2024: AR CORPORATION (Washington, DC) awarded $282,474

- Jan 05, 2024: SODEXO MANAGEMENT INC. (Gaithersburg, MD) awarded $73,237