| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2025 U.S. Industry Statistics & Market Forecast - Scenic and Sightseeing Transportation, Other

Market Size & Industry Statistics

The total U.S. industry market size for Scenic and Sightseeing Transportation, Other:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2020 2021 2022 2023 2024 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2025 | 2026 | 2027 | 2028 | 2029 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the Scenic and Sightseeing Transportation, Other industry include:- Increased interest in eco-tourism and sustainable travel

- Growing emphasis on unique and localized experiences

- Rise in international tourism

- Impact of social media on destination popularity

- Expansion of experiential travel over traditional sightseeing

- Technological advancements in booking and tour management

- Heightened safety regulations and standards

- Shifts in demographic targeting, including aging populations and millennials

- Climate change effects on natural tourist destinations

- Economic fluctuations affecting discretionary spending

Product & Services Breakdown

Research products and services in the Scenic and Sightseeing Transportation, Other industry generating sales. Note that products are broken into categories with different levels of classification.| Product Description | Number of Companies | Sales ($ millions) | Percent of Total Sales |

|---|---|---|---|

Industry Total |

|||

Sightseeing Services By Air |

|||

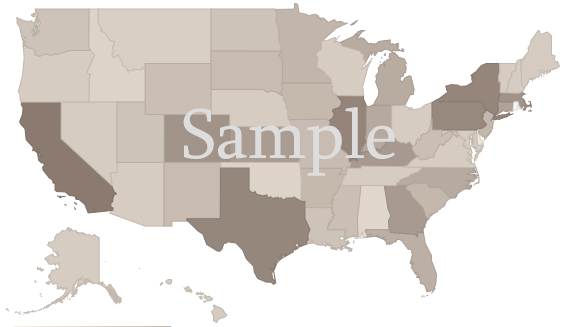

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a Scenic and Sightseeing Transportation, Other company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the Scenic and Sightseeing Transportation, Other industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on Scenic and Sightseeing Transportation, Other measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 8% | Order at top of page |

||

| Top Executives | 5% | |||

| General and Operations Managers | 5% | |||

| General and Operations Managers | 5% | |||

| Personal Care and Service Occupations | 11% | |||

| Tour and Travel Guides | 5% | |||

| Tour and Travel Guides | 5% | |||

| Office and Administrative Support Occupations | 21% | |||

| Information and Record Clerks | 9% | |||

| Reservation and Transportation Ticket Agents and Travel Clerks | 5% | |||

| Reservation and Transportation Ticket Agents and Travel Clerks | 5% | |||

| Installation, Maintenance, and Repair Occupations | 14% | |||

| Vehicle and Mobile Equipment Mechanics, Installers, and Repairers | 10% | |||

| Aircraft Mechanics and Service Technicians | 10% | |||

| Aircraft Mechanics and Service Technicians | 10% | |||

| Transportation and Material Moving Occupations | 34% | |||

| Air Transportation Workers | 21% | |||

| Aircraft Pilots and Flight Engineers | 19% | |||

| Commercial Pilots | 19% | |||

| Other Transportation Workers | 6% | |||

Scenic and Sightseeing Transportation, Other Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Scenic and Sightseeing Transportation, Other industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Scenic and Sightseeing Transportation, Other industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Scenic and Sightseeing Transportation, Other industry. |

Source:

Latest Industry News

- How I Spent 3 Days in St. Moritz as a Design Editor - I spent three days in St. Moritz, Switzerland, during the summer. Here's my design editor-approved itinerary including where to stay, shop, explore, and dine. (01/03/2025)

- "Laowai" in China | China's further opening up enhances experience of foreign visitors, businesses - Chinese cities and provinces such as Beijing, Shanghai and Guangdong have improved their mobile payment, bank card and cash services, as well as services that increase the ease of online shopping and transportation for foreign visitors. (01/03/2025)

- Explore Manali’s Beauty And Comfort Without Overspending - Manali can be experienced on a budget with thoughtful planning and smart decisions. Whether traveling alone, with friends, or as a family, it's possible to enjoy the breathtaking mountain views without breaking the bank. (01/02/2025)

- Legacy of Tea Horse Road lives on in Yunnan village - In Nakeli, there is no hustle and bustle of traffic, or check-in spots for social media influencers. It is a place where time seems to pass with a whisper. Yet while it's safe to assume the majority of Yunnan residents have never heard the name, Nakeli is home to a palpable cultural rebirth of the ancient Tea Horse Road. (01/01/2025)

- An Ultimate Guide to Car Hire and Driving in Albania - In this ultimate guide to car hire and driving in Albania, we’ll cover everything you need to know—from essential tips on renting a vehicle and navigating local roads to must-see destinations that will make your trip truly memorable. (12/31/2024)

- 10 Budget-Friendly Travel Destinations for 2025 - Where will you travel in 2025? While everyone has a different destination they want to check off their bucket list, most travelers ideally want to go to scenic locales that allow you to partake in (12/31/2024)

- M&T Bank Stadium Guide: Full Ravens schedule, concerts, seating map, close hotels and airports, parking, bags policy and more to know in Baltimore - Here is everything you need to know about M&T Bank Stadium, including a full schedule of upcoming events that will be held at the venue. (12/30/2024)

- How to Visit Arches and Canyonlands in One Day - If you only have one day to visit Arches and Canyonlands National Parks, get ready to have an action packed day filled with gorgeous overlooks, scenic drives, and short hikes. These two national parks are located in Moab, (12/29/2024)

- Japan’s scenic hot springs town restricting tourists amid fights over the best photo spots - Ginzan Onsen, a popular Japanese hot spring town known for its scenic snowy views ... to regulate visits as Japan receives a record tourism boom in recent months. The country already recorded ... (12/27/2024)

- Study on the Spatial Distribution Characteristics and Influencing Factors of National Scenic Spots in China () - With the help of ArcGIS analysis tools, this paper takes 244 national scenic spots in nine batches as the specific research objects, and uses the geographic concentration index research method to explore the spatial distribution status and influencing factors of scenic spots in China. (12/24/2024)

Related Reports

Can't find what you're looking for? We have over a thousand

market research reports.

Ask us and an analyst will help you find what you need.