| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2024 U.S. Industry Statistics & Market Forecast - Chemical and Allied Products Merchant Wholesalers

Market Size & Industry Statistics

The total U.S. industry market size for Chemical and Allied Products Merchant Wholesalers:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2019 2020 2021 2022 2023 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the Chemical and Allied Products Merchant Wholesalers industry include:- Increased regulation and compliance requirements

- Global supply chain disruptions

- Growth in green and sustainable chemical products

- Advancements in technology and automation

- Increased competition from manufacturers selling directly to consumers

- Shifts in global economic power affecting international trade

- Growing demand in emerging markets

- Impact of tariffs and trade barriers

- Rise in specialty chemicals

- Increased emphasis on safety and risk management

- Customer demand for integrated supply solutions

- Fluctuations in raw material prices

Product & Services Breakdown

Research products and services in the Chemical and Allied Products Merchant Wholesalers industry generating sales. Note that products are broken into categories with different levels of classification.| Product Description | Number of Companies | Sales ($ millions) | Percent of Total Sales |

|---|---|---|---|

Industry Total |

|||

Plywood, Panels, And Millwork, Including Doors, Windows, And Wood Fence |

|||

Other Construction Products And Materials |

|||

Restaurant And Hotel Equipment And Supplies |

|||

Flat Iron And Steel Products |

|||

Iron And Steel Wire And Wire Products |

|||

Iron And Steel Pipes And Tubing |

|||

Hardware |

|||

Plumbing And Hydronic Heating Equipment And Supplies, Including Gas Plumbing Appliances And Water Heaters |

|||

General-Purpose Industrial Machinery, Equipment, And Parts |

|||

Welding Supplies, Excluding Gases |

|||

Industrial Containers And Supplies |

|||

Abrasives, Strapping, Tape, Ink, And Mechanical Rubber Goods |

|||

Janitorial Equipment And Supplies |

|||

Commercial Laundry And Dry-Cleaning Equipment And Supplies |

|||

Safety Equipment |

|||

Paper And Plastic Products |

|||

Pharmaceuticals, Pharmaceutical Supplies, Cosmetics, And Toiletries, Including Body And Hand Soaps |

|||

Grocery Specialties |

|||

Grains, Beans, And Seeds |

|||

Corn, Excluding Corn Grown For Silage |

|||

Seeds And Other Grains, Beans, And Rice |

|||

Plastics Materials And Basic Shapes |

|||

Plastic Pipes, Rods, Tubes, And Shapes, Excluding Plumbing |

|||

High Pressure Laminates |

|||

Plastics Raw Materials |

|||

Other Plastics Materials And Basic Shapes |

|||

Plastic Plumbing Pipes And Tubing |

|||

Plastic Materials And Basic Shapes For Electrical Use |

|||

Polystyrene And Polyurethane Foam |

|||

Other Plastics Film, Sheet, And Foam |

|||

Industrial Gases, Including Welding Gases |

|||

Oxygen |

|||

Acetylene And Other Welding Gases |

|||

Other Industrial Gases |

|||

Chemicals And Allied Products, Excluding Agricultural Chemicals, Plastics, Industrial And Natural Gases, Liquefied Petroleum (Lp |

|||

Compressed And Liquefied Gases, Excluding Liquefied Petroleum (Lp) |

|||

Alkalies And Chlorine |

|||

Detergents And Soaps, Excluding Body And Hand Soaps |

|||

Wood Chemicals, Naval Stores, And Gum |

|||

Biofuels, Including Ethanol, Methanol, Biodiesel, And Gasohol Not Included With Petroleum Products |

|||

Nonagricultural Insecticides |

|||

Adhesives, Sealants, And Glues |

|||

Explosives, Except Ammunition And Fireworks |

|||

Other Chemicals And Allied Products |

|||

Home Cleaning Chemical Solutions, Polishes, And Waxes |

|||

Industrial And Institutional Sanitation Chemical Solutions, Polishes, And Waxes |

|||

Automotive Chemicals, Including Polishes And Cleaners, Fuel And Oil Additives, And Antifreeze |

|||

Drilling Chemicals, Including Drilling Mud |

|||

Dry Ice |

|||

Refined Petroleum Products, Excluding Liquefied Petroleum (Lp) |

|||

Liquefied Petroleum (Lp) |

|||

Crude Oil |

|||

Farm Supplies |

|||

Paint, Paint Supplies, Wallpaper, And Wallpaper Supplies |

|||

Service Receipts And Labor Charges, Including Installed Parts |

|||

Miscellaneous Commodities |

|||

Rental And Operating Lease Receipts |

|||

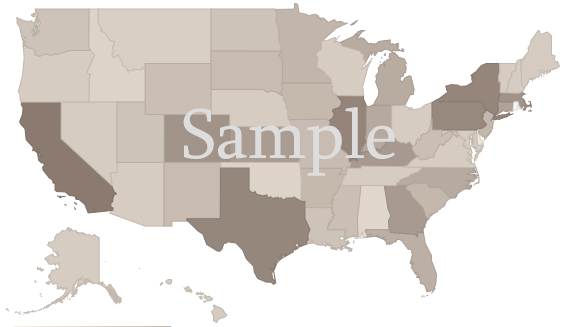

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a Chemical and Allied Products Merchant Wholesalers company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the Chemical and Allied Products Merchant Wholesalers industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on Chemical and Allied Products Merchant Wholesalers measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 9% | Order at top of page |

||

| Chief Executives | 0% | |||

| General and Operations Managers | 4% | |||

| Business and Financial Operations Occupations | 6% | |||

| Sales and Related Occupations | 18% | |||

| Sales Representatives, Wholesale and Manufacturing | 14% | |||

| Sales Representatives, Wholesale and Manufacturing | 14% | |||

| Sales Representatives, Wholesale and Manufacturing, Except Technical and Scientific Products | 12% | |||

| Office and Administrative Support Occupations | 14% | |||

| Production Occupations | 5% | |||

| Transportation and Material Moving Occupations | 36% | |||

| Motor Vehicle Operators | 15% | |||

| Driver/Sales Workers and Truck Drivers | 15% | |||

| Heavy and Tractor-Trailer Truck Drivers | 8% | |||

| Material Moving Workers | 19% | |||

| Laborers and Material Movers | 17% | |||

| Laborers and Freight, Stock, and Material Movers, Hand | 8% | |||

| Stockers and Order Fillers | 7% | |||

Chemical and Allied Products Merchant Wholesalers Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Chemical and Allied Products Merchant Wholesalers industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Chemical and Allied Products Merchant Wholesalers industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Chemical and Allied Products Merchant Wholesalers industry. |

Innovation News

- Jun 13, 2024: Bayotech patents Hydrogen Generation Systems

- Jun 13, 2024: Garrison Group patents Dry Powder Mixture For Total Phosphorus Removal Within Water And Wastewater Treatment

- Jun 13, 2024: Aculon patents Coated Medical Guidewires And Methods Of Making Them

- Mar 04, 2024: Cot'n Wash raises $6 million in funding.

- Jan 16, 2024: A.g. Layne trademarks "A.G. LAYNE CHEMICAL COMPANY" - edible oils for general industrial, agricultural and commercial use

- Jan 16, 2024: Valudor Products trademarks "VALUDOR" - construction materials

- Jan 11, 2024: Alpine Technical Services trademarks "INNOVA" - Bacteria for waste water treatment; Chemical preparations for use in soil remediation, drinking water treatment, municipal and industrial wastewater treatment; Chemicals for the treatment of water and wastewater; Waste water treatment chemicals for industrial use

- Dec 20, 2023: Claros Technologies raises $18 million in funding.

- Dec 14, 2023: Claros Technologies raises $14 million in funding.

Recent Federal Contracts for Chemical and Allied Products Merchant Wholesalers

- Apr 02, 2024: RAS ENTERPRISES LLC (Gulfport, MS) awarded $9,647

- Mar 27, 2024: INTEK MARINE TECHNOLOGY, LLC (Fairfax, VA) awarded $2,139

- Mar 15, 2024: GALLUP WELDERS SUPPLY, INC. (Gallup, NM) awarded $48,428

- Mar 11, 2024: FSR CONSULTING LLC (Lansdale, PA) awarded $53,816

- Mar 05, 2024: GARON PRODUCTS INC (Sea Girt, NJ) awarded $19,004

- Feb 28, 2024: BISON GROUP, INC. (Ontario, CA) awarded $7,672