| Standard Report | Premium Report | |

|---|---|---|

| Current State of the Industry |  |

|

| Market Size (industry trends) |  |

|

| Market Forecast (5-year projection) |  |

|

| Products/Services Breakdown |  |

|

| Revenue per State |  |

|

| Financial Metrics |  |

|

| Salary & Compensation Statistics |  |

|

| Public Company Information |  |

|

| Key Private Companies |  |

|

| Government Vendors |  |

|

| Instant Download - Available immediately upon purchase |  |

|

Download both PDF and Excel

|

|

|

| Download now: |

2024 U.S. Industry Statistics & Market Forecast - Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers

Market Size & Industry Statistics

The total U.S. industry market size for Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers:

Industry statistics cover all companies in the United States, both public and private, ranging in size from small businesses to market leaders.

In addition to revenue, the industry market analysis shows information on employees, companies, and average firm size.

Investors, banks, and business executives use growth rates and industry trends to understand the market outlook and opportunity.

| Statistics | 2019 2020 2021 2022 2023 | |

|---|---|---|

| Market Size (Total Sales/Revenue) |

Order at top of page | |

| Total Firms | ||

| Total Employees | ||

| Average Revenue Per Firm | ||

| Average Employees Per Firm | ||

| Average Revenue Per Employee | ||

Market Forecast

Market forecasts show the long term industry outlook and future growth trends. The following extended five-year forecast projects both short-term and long-term trends.

| Forecast / Industry Outlook | 2024 | 2025 | 2026 | 2027 | 2028 |

|---|---|---|---|---|---|

| Market Forecast ($ millions) | |||||

| Projected Industry Growth Rate (%) | |||||

Industry Insights

Major trends affect the Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers industry include:- Electrification of vehicles increasing demand for electric components

- Autonomous driving technology advancements

- Shift towards e-commerce and online parts distribution

- Stringent environmental regulations influencing product offerings

- Global supply chain disruptions impacting inventory and costs

- Rise in aftermarket parts sales due to vehicle longevity

- Integration of advanced technology in parts for performance enhancement

- Increased focus on sustainability in manufacturing and supply chain processes

- Growing importance of data analytics for inventory and fleet management

- Expansion in emerging markets driving demand for vehicles and parts

- Consumer preference shifts towards more fuel-efficient and hybrid models

- Collaborations and partnerships between OEMs and technology companies

- Escalating trade tensions influencing import/export costs and strategies

- Economic fluctuations affecting consumer buying power and investment trends

Product & Services Breakdown

Research products and services in the Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers industry generating sales. Note that products are broken into categories with different levels of classification.| Product Description | Number of Companies | Sales ($ millions) | Percent of Total Sales |

|---|---|---|---|

Industry Total |

|||

New And Used Automobiles, Crossovers, Motorcycles, And Trailers |

|||

New Automobiles, Including Crossovers |

|||

Used Automobiles, Including Crossovers |

|||

Motorcycles |

|||

Utility Trailers |

|||

All-Terrain Vehicles (Atvs), Snowmobiles, Motor Scooters, Mopeds, And Other Motorized Recreational-Use Vehicles |

|||

Buses, Campers, And Motor Homes |

|||

Buses |

|||

Motor Homes, Travel Trailers, And Campers |

|||

Light Trucks And Truck Bodies, 14, 000 Lb. Or Less, Including Vans, Cargo Vans, And Suvs |

|||

New Light Trucks And Suvs |

|||

Used Light Trucks And Suvs |

|||

New And Used Vans And Cargo Vans |

|||

New Light Truck, Van, And Suv Bodies |

|||

Medium Trucks, Truck Bodies, And Tractors, 14, 001 Lb. To 33, 000 Lb. |

|||

New Medium Trucks And Tractors |

|||

Used Medium Trucks And Tractors |

|||

New Medium Truck Bodies |

|||

Heavy Trucks, Truck Bodies, Trailers, And Road Tractors, More Than 33, 000 Lb. |

|||

New Heavy Trucks |

|||

New Heavy Truck Tractors |

|||

New Truck Trailers |

|||

New Heavy Truck Bodies |

|||

Used Heavy Trucks, Tractors, And Trailers |

|||

New And Rebuilt Automotive And Trailer Parts And Supplies |

|||

Automotive Batteries |

|||

Complete Engines |

|||

Electrical Engine Parts, Including Ignition Parts |

|||

Brake Parts, Including Fluid And All Disk And Drum Parts |

|||

Exhaust System Parts |

|||

Automotive Glass |

|||

Hoses, Belts, Gaskets, And Wiper Blades |

|||

Filters, Including Oil, Air, Gas, And Transmission |

|||

Engine Parts, Excluding Electrical Parts |

|||

Body Parts And Repair Materials |

|||

Suspension Parts, Including Shocks, Struts, And Ball Joints |

|||

Other Automotive Parts And Supplies |

|||

Automotive Accessories, Excluding Car Stereos And CD Players |

|||

Used Automotive Parts, Accessories, And Equipment |

|||

Petroleum Products Marketing Equipment |

|||

Tires And Tubes |

|||

New Automobile Tires And Tubes |

|||

Re-Treaded And Used Automobile Tires And Repair Materials |

|||

New Truck And Bus Tires, Including Industrial, Off-Road, And Farm Tractor Tires |

|||

Re-Treaded And Used Truck And Bus Tires And Repair Materials, Including Industrial, Off-Road, And Farm Tractor Tires |

|||

Electrical Apparatus And Equipment |

|||

Electric And Gas Household Appliances, Excluding Plumbing |

|||

Car Stereos, Tape Players, And CD Players |

|||

Electronic Parts And Equipment, Excluding Communications Equipment |

|||

Hardware |

|||

Construction, Forestry, And Mining Machinery And Equipment, Including Parts And Attachments |

|||

Farm Machinery, Equipment, And Parts |

|||

General-Purpose Industrial Machinery, Equipment, And Parts |

|||

Marine Machinery, Equipment, And Supplies |

|||

Recyclable Ferrous Metal Scrap |

|||

Recyclable Nonferrous Metal Scrap |

|||

Chemicals And Allied Products, Excluding Agricultural Chemicals, Plastics, Industrial And Natural Gases, Liquefied Petroleum (Lp |

|||

Other Chemicals And Allied Products |

|||

Automotive Chemicals, Including Polishes And Cleaners, Fuel And Oil Additives, And Antifreeze |

|||

Refined Petroleum Products, Excluding Liquefied Petroleum (Lp) |

|||

Paint, Paint Supplies, Wallpaper, And Wallpaper Supplies |

|||

Service Receipts And Labor Charges, Including Installed Parts |

|||

Labor Charges For Repair Work |

|||

Parts Installed In Repair Work |

|||

Other Service Receipts And Labor Charges |

|||

Receipts For Service Contracts |

|||

Miscellaneous Commodities |

|||

Rental And Operating Lease Receipts |

|||

Receipts For Machine Shop Job Work, Including Receipts For Custom Built, Rebuilt, Or Repaired Parts |

|||

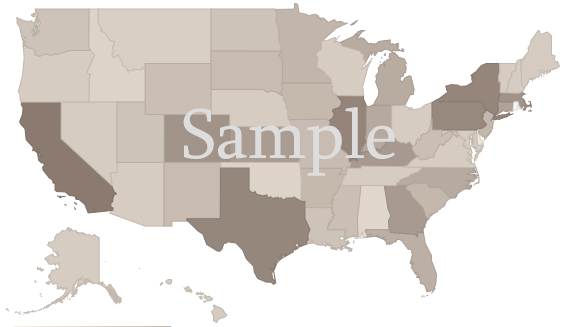

U.S. Geographic Distribution: Revenue Statistics by State

Market Size by State ($ millions) indicates how the industry's competition is distributed throughout the country. State-level information can identify areas with higher and lower industry market share than average.

Income Statement (Average Financial Metrics)

Financial metrics provide a snapshot view of a benchmark "average" company. Key business metrics show revenue and operating costs. The data collected covers both public and private companies.| Industry Average | Percent of Sales (Industry Benchmark) |

|

|---|---|---|

| Total Revenue | Order at top of page |

|

| Operating Revenue | ||

| Cost of Goods Sold | ||

| Gross Profit | ||

Operating Expenses | ||

| Pension, profit sharing plans, stock, annuity | ||

| Repairs | ||

| Rent paid on business property | ||

| Charitable Contributions | ||

| Depletion | ||

| Domestic production activities deduction | ||

| Advertising | ||

| Compensation of officers | ||

| Salaries and wages | ||

| Employee benefit programs | ||

| Taxes and Licenses | ||

| Bad Debts | ||

| Depreciation | ||

| Amortization | ||

| Other Operating Expenses | ||

| Total Operating Expenses | ||

| Operating Income | ||

| Non-Operating Income | ||

| EBIT (Earnings Before Interest and Taxes) | ||

| Interest Expense | ||

| Earnings Before Taxes | ||

| Income Tax | ||

| Net Profit Net Income | ||

Financial Ratio Analysis

Financial ratio information can be used to benchmark how a Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers company compares to its peers. Accounting statistics are calculated from the industry-average for income statements and balance sheets.| Profitability & Valuation Ratios | Industry Average |

|---|---|

| Company valuation can be measured based on the firm's own performance, as well as in comparison against its industry competitors. These metrics show how the average company in the Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers industry is performing. | |

| Profit Margin Gross Profit Margin, Operating Profit Margin, and Net Profit Margin. Show company earnings relative to revenues. |

|

| Return on Equity (ROE) Return on Equity (ROE) is net income as a percentage of shareholders' equity. Shareholders' Equity is defined as the company's total assets minus total liabilities. ROE shows how much profits a company generates with the money shareholders invested (or with retained earnings). |

|

| Return on Assets (ROA) Return on Assets (ROA) is net income relative to total assets. The market research on Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers measures how efficiently the company leverages its assets to generate profit. ROA is calculated as Net Income divided by Total Assets. |

|

| Liquidity Ratios | Industry Average |

|---|---|

| Bankers and suppliers use liquidity to determine creditworthiness and identify potential threats to a company's financial viability. | |

| Current Ratio Measures a firm's ability to pay its debts over the next 12 months. |

|

| Quick Ratio (Acid Test) Calculates liquid assets relative to liabilities, excluding inventories. |

|

| Efficiency Ratios - Key Performance Indicators | Industry Average |

|---|---|

| Measure how quickly products and services sell, and effectively collections policies are implemented. | |

| Receivables Turnover Ratio If this number is low in your business when compared to the industry average in the research report, it may mean your payment terms are too lenient or that you are not doing a good enough job on collections. |

|

| Average Collection Period Based on the Receivables Turnover, this estimates the collection period in days. Calculated as 365 divided by the Receivables Turnover |

|

| Inventory Turnover A low turnover rate may point to overstocking, obsolescence, or deficiencies in the product line or marketing effort. |

|

| Fixed-Asset Turnover Generally, higher is better, since it indicates the business has less money tied up in fixed assets for each dollar of sales revenue. |

|

Compensation & Salary Surveys for Employees

Compensation statistics provides an accurate assessment of industry-specific jobs and national salary averages. This information can be used to identify which positions are most common, and high, low, and average annual wages.| Title | Percent of Workforce | Bottom Quartile | Average (Median) Salary | Upper Quartile |

|---|---|---|---|---|

| Management Occupations | 7% | Order at top of page |

||

| Chief Executives | 0% | |||

| General and Operations Managers | 4% | |||

| Sales and Related Occupations | 21% | |||

| Retail Sales Workers | 9% | |||

| Counter and Rental Clerks and Parts Salespersons | 7% | |||

| Parts Salespersons | 6% | |||

| Sales Representatives, Wholesale and Manufacturing | 9% | |||

| Sales Representatives, Wholesale and Manufacturing | 9% | |||

| Sales Representatives, Wholesale and Manufacturing, Except Technical and Scientific Products | 9% | |||

| Office and Administrative Support Occupations | 15% | |||

| Installation, Maintenance, and Repair Occupations | 16% | |||

| Vehicle and Mobile Equipment Mechanics, Installers, and Repairers | 13% | |||

| Bus and Truck Mechanics and Diesel Engine Specialists | 7% | |||

| Bus and Truck Mechanics and Diesel Engine Specialists | 7% | |||

| Transportation and Material Moving Occupations | 29% | |||

| Motor Vehicle Operators | 13% | |||

| Driver/Sales Workers and Truck Drivers | 12% | |||

| Light Truck Drivers | 8% | |||

| Material Moving Workers | 14% | |||

| Laborers and Material Movers | 13% | |||

| Laborers and Freight, Stock, and Material Movers, Hand | 6% | |||

| Stockers and Order Fillers | 6% | |||

Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers Competitor Landscape & Key Companies [PREMIUM]

The most influential companies in the Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers industry and adjacent industries either have large market share or are developing new business models and methods that could disrupt the status quo. We look at leading and emerging companies in the Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers industry and adjacent sectors:| Market Leaders: Direct Competitors Companies with the largest market share, focused in this industry |

Market leaders: Diversified Competitors Largest companies that have diversified operations in this and other industries |

| Innovators: Direct Competitors Innovative, Emerging, and Disruptive Companies that may influence the future direction of the industry. |

Innovators: Diversified Competitors Innovators and Disruptors in adjacent industries that may also affect the Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers industry. |

Innovation News

- Jun 13, 2024: Toyota Motor North America patents Parking Monitoring And Assistance For Transports

- Jun 13, 2024: Toyota Motor North America patents Parking Monitoring And Assistance For Transports

- Jun 13, 2024: Eblock patents Advanced Platform For Hosting Physical And Virtual Events

- Jan 30, 2024: Kari trademarks "KARI TOYOTA" - Automobile dealerships

- Jan 23, 2024: Pittsburgh Glass Works trademarks "SOUNDMASTER" - Vehicle parts

- Jan 22, 2024: Pittsburgh Glass Works trademarks "CHROMAX" - Vehicle parts

- May 17, 2023: Salem raises $1 million in funding.

- Feb 08, 2023: Salem raises $1 million in funding.

- Jun 15, 2022: Raneys Holdings raises $66 million in funding.

Recent Federal Contracts for Motor Vehicle and Motor Vehicle Parts and Supplies Merchant Wholesalers

- Apr 01, 2024: MISCELLANEOUS FOREIGN AWARDEES (Washington, DC) awarded $13,646

- Mar 30, 2024: EASTERN LIFT TRUCK CO., INC. (Baltimore, MD) awarded $29,604

- Mar 20, 2024: CFAO MOTORS LIMITED (Lilongwe, ) awarded $52,363

- Mar 18, 2024: CAP 360 LLC (Findlay, OH) awarded $696,280

- Mar 12, 2024: THE TOOTA GROUP LLC (Lakewood, NJ) awarded $377,910

- Mar 07, 2024: ENTERPRISE RENT-A-CAR CO OF SAN FRANCISCO, LLC (San Ramon, CA) awarded $2,223